You have many options and many things to think about when you're thinking of buying a home. Save for the downpayment, locate a house in a great school district, and check that the house is in good repair. Also, you should consider the culture and businesses in your neighborhood. Lastly, make sure that the mortgage payment is something you can comfortably afford. The last thing you want is to buy a home that's too expensive for you.

For a down payment, save money

FDIC-insured savings accounts are the best places to save money for a downpayment on a new house. These accounts have higher than average interest rates and are easy to access. It may be wiser to invest your money on the market if you intend to buy a home for the long-term. This can lead to a higher return.

Start by calculating your income. Start by calculating your monthly income and adding in the income of your spouse if you have one. You can review your bank statements or credit card bills.

Find a house near a great school district

A family's decision to buy a house is often influenced by the proximity of schools. But, quality is not the only factor that matters. Other factors, such as commute times and school standards, can also be important. It is important to reflect on all of these aspects and be willing to make sacrifices.

First, it is important to find a property in a great school district if you are buying a home for yourself or your family. This will make it more attractive and easier to sell. Second, if you're considering buying a house for your children, a good school district will give them the best education. There are special programs for children with disabilities in some schools.

A home inspection

Getting a home inspection before you buy a house is important for a variety of reasons. It gives you a sense you are in control and can help you negotiate with the seller. A well-maintained property is worth buying. However, if there are any issues, the inspector's inspection report can help to negotiate a fair price or convince a seller to fix them.

You may be able to negotiate with the seller to repair or lower the price if a home inspection uncovers significant issues, such as a leaking water heater. If you don’t want to spend the money on repairs, you can always walk away. Often, the seller will agree for a home examination as part of the contract.

FAQ

Is it possible sell a house quickly?

If you plan to move out of your current residence within the next few months, it may be possible to sell your house quickly. But there are some important things you need to know before selling your house. First, you must find a buyer and make a contract. Second, prepare the house for sale. Third, your property must be advertised. Finally, you should accept any offers made to your property.

What should you look for in an agent who is a mortgage lender?

Mortgage brokers help people who may not be eligible for traditional mortgages. They work with a variety of lenders to find the best deal. There are some brokers that charge a fee to provide this service. Others offer free services.

What is the cost of replacing windows?

Windows replacement can be as expensive as $1,500-$3,000 each. The total cost of replacing all of your windows will depend on the exact size, style, and brand of windows you choose.

What is the average time it takes to sell my house?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It may take up to 7 days, 90 days or more depending upon these factors.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

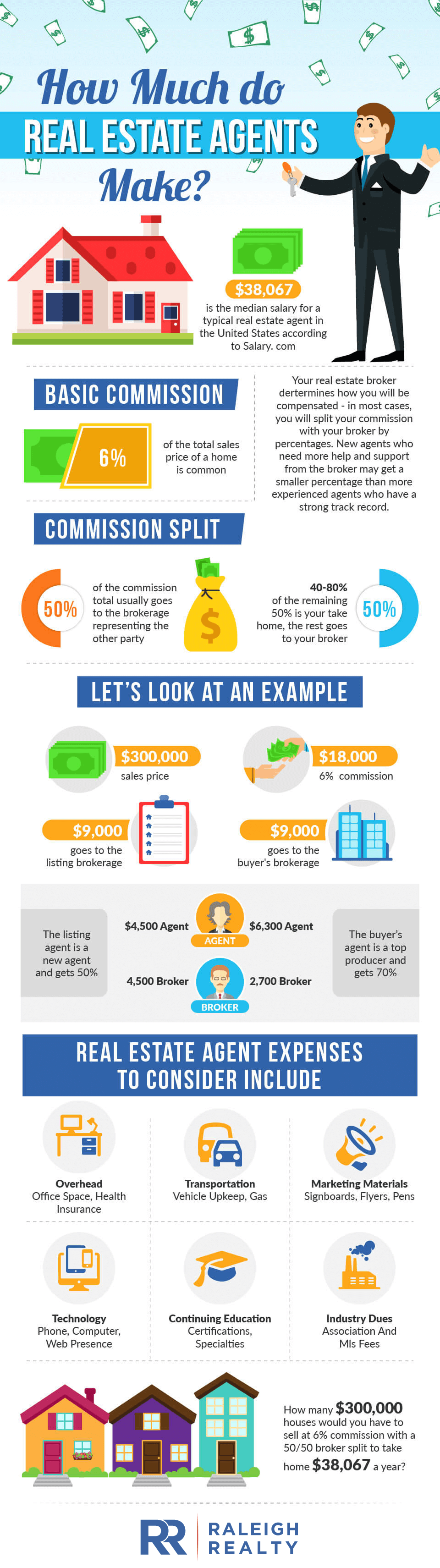

How to Find Real Estate Agents

The real estate agent plays a crucial role in the market. They are responsible for selling homes and property, providing property management services and legal advice. A good real estate agent should have extensive knowledge in their field and excellent communication skills. Online reviews are a great way to find qualified professionals. You can also ask family and friends for recommendations. Local realtors may also be an option.

Realtors work with sellers and buyers of residential property. A realtor's job is to help clients buy or sell their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. Most realtors charge a commission fee based on the sale price of the property. However, some realtors don't charge a fee unless the transaction closes.

The National Association of Realtors(r) (NAR), offers many different types of real estate agents. NAR members must pass a licensing exam and pay fees. A course must be completed and a test taken to become certified realtors. NAR has set standards for professionals who are accredited as realtors.