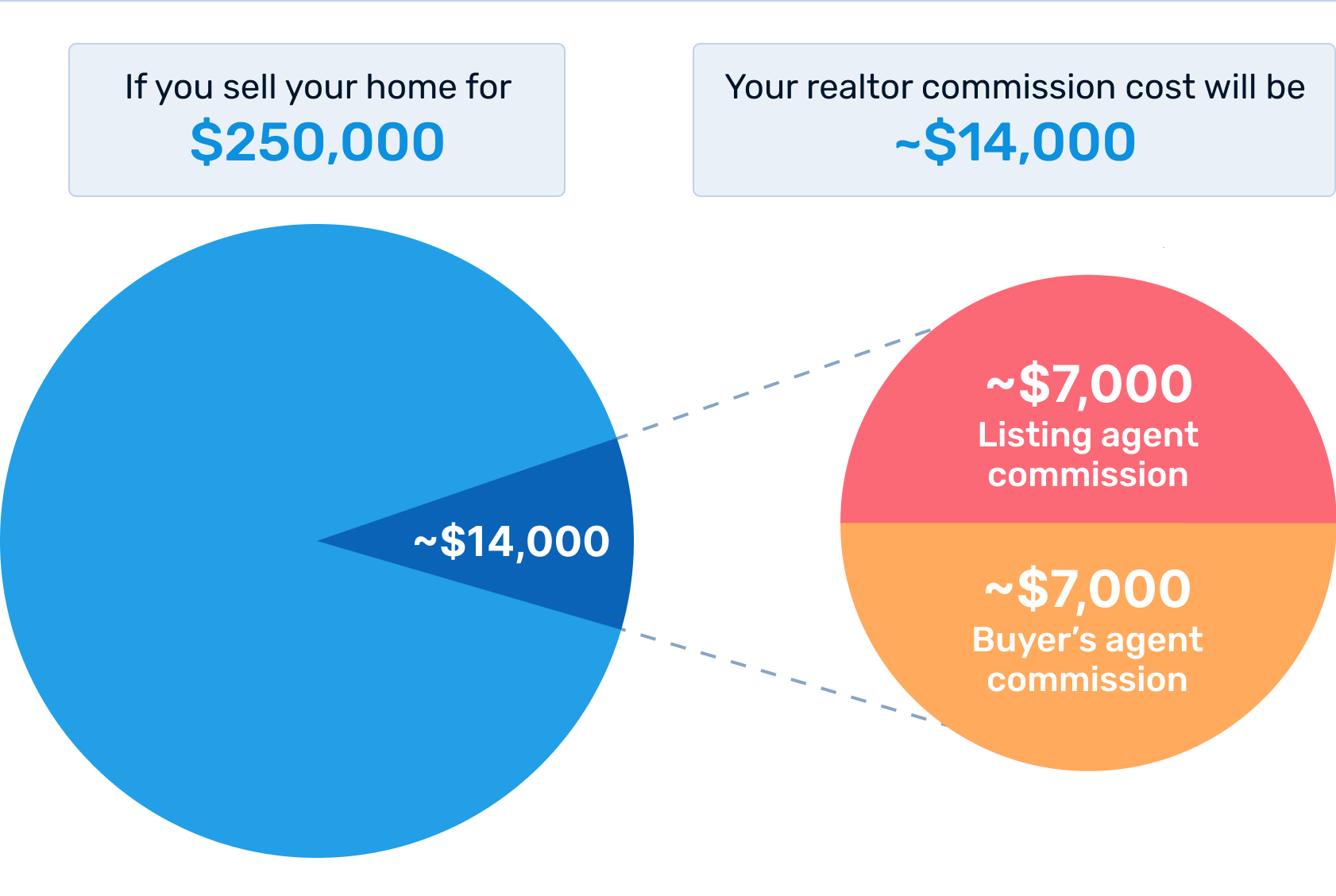

A typical New York real estate commission is split evenly between the buyer's and listing agents. The listing agent gets 3%, while the buyer's agent gets 3%. There may be no buyer's representative in certain cases and the listing agency collects the full 6 percent commission. Agents account for over 95%, according to estimates. The seller signs a contract usually with the agent listing the property.

Flat fee

New York's real estate market is different from other areas of the country. Listings may include "No Fee" labels or "No Broker Fee" but if renting an apartment you will need to pay the realty agent anywhere between 8% and 15% of the annual rental. The typical commission rate for real estate agents in New York is 12%. Saving thousands of dollars can be achieved by avoiding paying commissions.

Selling or buying a house? The seller usually pays the commission at the closing. If you are selling your home "For sale by owner", you will not pay a commission. To get your listing placed on the local MLS, you will still have to pay a flat rate. This flat fee listing will include the seller’s contact information as well show instructions.

Brokerage fees

The Consumer Federation of America published a report about the differences in New York City's real estate commission rates. This report showed huge variations in commission rates across different areas. The typical buyer agent rate varied from 1% in Brooklyn to 3% for Manhattan. This gap in total compensation was even greater as Manhattan homes cost much more than Brooklyn homes.

New York's real estate brokers charge fees that are negotiable. While brokers charge a 15% fee, most buyers and sellers will accept a lower fee. If you are moving fast, have your paperwork in order, and have a substantial deposit, brokers will be willing to accept a lower fee. Brokers have to assess how much competition is in the region.

Dual agency

Dual agency is a type of legal arrangement in realty in which both the buyer or seller can use a single agent. Dual agency is a legal arrangement in real estate that has pros and con for both the seller and buyer. It can speed up the process of the transaction by resolving questions faster. This arrangement can benefit sellers and buyers with extensive experience.

The overall transaction costs can be reduced by using dual agency. Dual agency arrangements often result in savings of approximately one to two percentages on the commission. The parties involved have more negotiation flexibility.

FAQ

How much money do I need to save before buying a home?

It depends on how long you plan to live there. If you want to stay for at least five years, you must start saving now. But if you are planning to move after just two years, then you don't have to worry too much about it.

How can I fix my roof

Roofs may leak from improper maintenance, age, and weather. Roofers can assist with minor repairs or replacements. Contact us for more information.

How can I find out if my house sells for a fair price?

If you have an asking price that's too low, it could be because your home isn't priced correctly. A home that is priced well below its market value may not attract enough buyers. Our free Home Value Report will provide you with information about current market conditions.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to be a real-estate broker

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This requires you to study for at least two hours per day for a period of three months.

This is the last step before you can take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

You are now eligible to work as a real-estate agent if you have passed all of these exams!